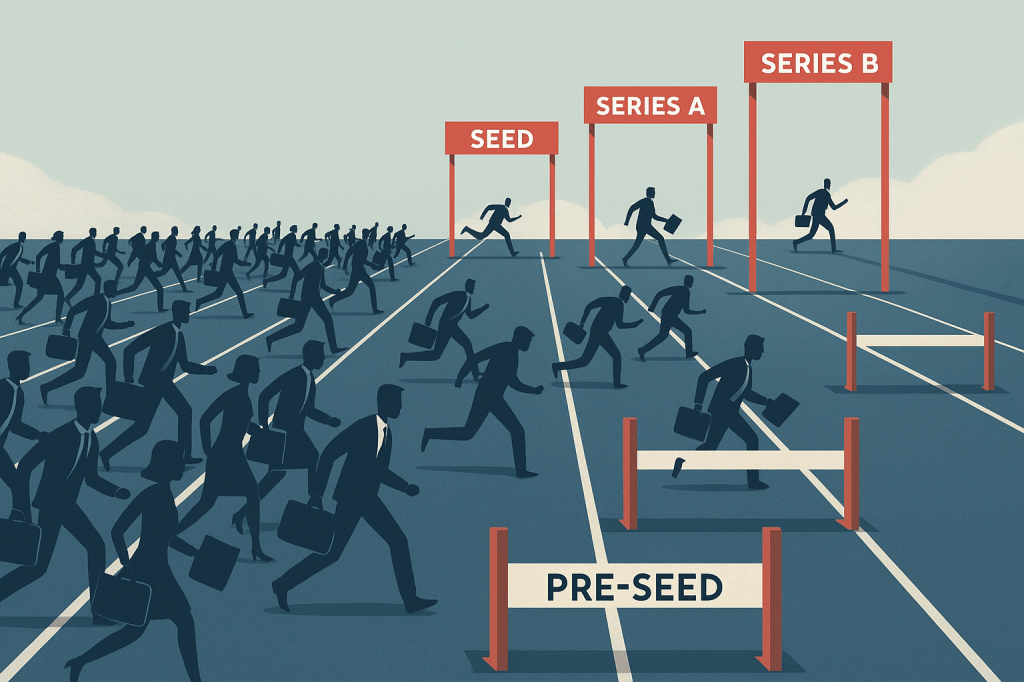

The venture landscape has undergone a profound transformation. What was once a predictable progression from seed to Series A has become a treacherous passage where four out of five startups perish. This isn’t merely a market correction—it’s a fundamental recalibration of what it means to build enduring value in the digital age.

The Arithmetic of Ambition

The numbers tell a stark story. In the halcyon days of 2020, nearly a quarter of U.S. seed-funded startups reached Series A within two years. By 2022, that figure had collapsed to a mere 5%. For SaaS startups specifically, the chasm has grown even wider: only 12% of those who raised seed in 2022 managed to secure Series A by mid-2024, compared to 37% from the 2020 cohort.

This isn’t simply about market cycles. It represents a philosophical shift in how investors perceive value creation. The era of “growth at any cost” has yielded to an age where efficiency and sustainability reign supreme.

Regional Realities: A Tale of Three Ecosystems

United States: The Epicenter of Excellence American startups historically enjoyed the highest graduation rates, with 51-61% of pre-2021 seed companies eventually reaching Series A or beyond. Today’s founders face a dramatically different reality, where only one-third of seed companies progress further.

India: The Crucible of Constraint The Indian ecosystem presents perhaps the greatest challenge, with conversion rates hovering around 20%—cited as “the lowest among all ecosystems.” This stark reality reflects both the intensity of competition and the scarcity of Series A capital willing to back emerging markets.

Australia & New Zealand: The Boutique Battlefield ANZ mirrors global trends with conversion rates around 15-25%, constrained by a smaller pool of investors and the geographic isolation that requires exceptional companies to attract international capital.

Time: The Ultimate Truth Teller

The temporal dimension reveals another crucial truth: excellence cannot be rushed. The median time from seed to Series A has stretched from 20 months in 2021 to nearly 24 months today. Many companies now require 24-30 months to demonstrate the traction that investors demand.

This extension isn’t merely about market conditions—it reflects a deeper understanding that sustainable businesses require time to mature. Bridge rounds and extended seed funding have become structural features rather than emergency measures, with nearly half of all Series A financings in 2023 being extensions rather than new rounds.

The Economics of Expectation

Round Sizes: Bigger Bets, Higher Bars

U.S. Series A rounds have evolved from the $5-8 million norm of a decade ago to today’s $10-15 million standard. The 2021 peak saw median rounds of $12 million, dropping to $9-10 million in 2023 before rebounding in 2024 as AI-driven optimism returned.

Indian startups reached a milestone in 2021 when average Series A deals first hit $10 million, maintaining around $11 million through 2022. ANZ rounds remain more modest, typically ranging from $5-8 million USD, reflecting the regional capital constraints.

Valuations: The Price of Progress

Pre-money valuations tell a story of boom, correction, and cautious recovery:

- U.S.: From pre-pandemic medians of $25 million to 2022 peaks of $50+ million, settling around $38-44 million today

- India: Rising from $15-25 million historically to $30-40 million for quality startups

- ANZ: More conservative $15-30 million range, unless attracting international investors

The New Imperatives: Four Pillars of Series A Success

The elevated bar demands a fundamental shift in how founders approach growth:

1. Runway Resilience

Plan for 24-30 months of capital between seed and Series A. The days of 18-month sprints are over.

2. Metric Mastery

Investors now expect $1-2 million ARR, 80%+ gross margins, and burn multiples under 2x. Quality of growth trumps velocity.

3. Geographic Agility

Strong SaaS startups increasingly transcend regional boundaries. Indian companies leverage global revenue streams; ANZ startups court international investors.

4. Efficiency Excellence

The Rule of 40 isn’t just a benchmark—it’s becoming table stakes for serious consideration.

The Philosophical Foundation

At its core, this transformation reflects a return to fundamental principles. The market has rediscovered that sustainable value creation requires discipline, patience, and genuine customer value. The companies that survive this crucible won’t just be stronger—they’ll be fundamentally different beasts, built for endurance rather than mere velocity.

The “Series A crunch” isn’t a temporary inconvenience—it’s a permanent elevation of standards. For founders willing to embrace this reality, it represents not an obstacle but an opportunity to build companies of lasting significance.

The great graduation crisis, paradoxically, may prove to be venture capitalism’s greatest gift: a forced return to the timeless principles of building businesses that matter.

Sources and References

1. Crunchbase News: U.S. seed-stage outcomes and graduation rates: news.crunchbase.com

2. LinkedIn Analysis: Series A conversion trends and timing: linkedin.com

3. Carta Research: Fundraising timelines and valuation datacarta.com

4. Allegory Capital: Early-stage market commentary: allegory.capital

5. Bain & Company: India VC trends and deal sizes: bain.com

6. ITIC IITH: Indian startup ecosystem analysis:itic.iith.ac.in

7. ScaleUp Finance: SaaS-specific funding research:scaleup.finance

8. Aurelia Ventures: Series A valuation benchmarks aureliaventures.com

9. Morgan Stanley: India tech startup valuations: morganstanley.com

20. Cutthrough Venture: Australian funding trends: cutthrough.com